https://srsroccoreport.com/chart-of-the-week-the-surprising-drop-in-u-s-crude-oil-production/?doing_wp_cron=1597641959.8527040481567382812500

CHART OF THE WEEK: The Surprising Drop In U.S. Crude Oil Production

U.S. crude oil production experienced a surprising drop last week, even though domestic demand for oil and petroleum products increased. This came as a surprise to some energy analysts. Furthermore, the IEA, International Energy Agency came out with a forecast for global oil demand to fall 8.1 million barrels per day in 2020.

I have to say, this is terrible news coming from the IEA. Just last month, the IEA stated that global oil demand could fall to 7.1 mbd (million barrels per day), but only recently updated their forecast for an 8.1 mbd decline in 2020 due to “gloomy airline travel.”

Actually, we don’t really know what global oil demand will look like by the end of the year. There are way too many variables. Even though the Fed and central banks are planning to pump in more stimulus plans over the next few months, the negative SNOWBALL EFFECT of all the closed stores, unemployment, commercial real estate armageddon, collapse in airline travel, supply chain disruptions, and so forth, will likely impact oil demand to a greater degree by the end of 2020 and into 2021.

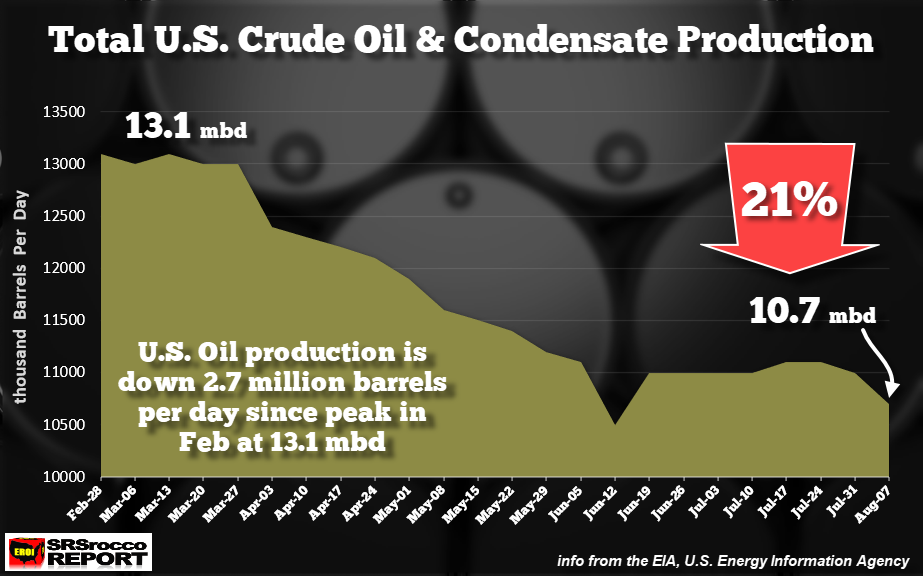

Another CURVEBALL to hit the United States is the coming collapse in U.S. Shale oil production. While some companies have curtailed production, and are now bringing some of it back online, total U.S. crude oil production surprisingly declined to 10.7 mbd last week.

U.S. crude oil production reached a peak of 13.1 mbd in late February, right before the global contagion and shutdown of economies. It fell to a low of 10.5 mbd in mid-June, then rebounded to 11.0 mbd for the next two months. However, in the lasted EIA, U.S. Energy Information Agency weekly report, U.S. oil production fell from 11.0 mbd to 10.7 mbd last week.

Total U.S. oil production is down 21% from its highs set earlier this year. While I knew shale oil production in the states was going to decline shortly due to its lousy economics, high decline rates, and falling reserves, the global contagion just sped the process up a bit.

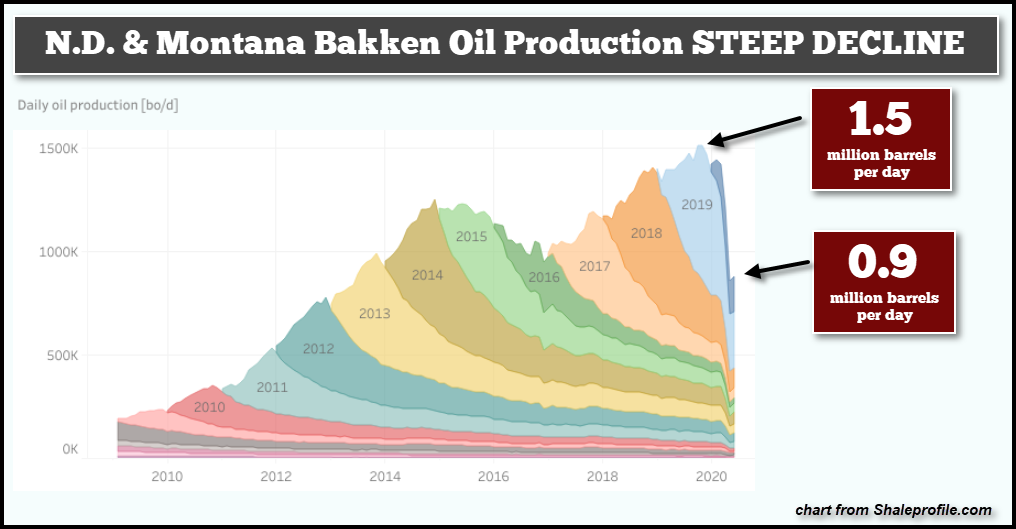

One of the worse production declines is taking place in the Bakken. According to Shaleprofile.com, that receives its data from the North Dakota Department of Resources, the Bakken’s oil production has fallen from a high of 1.5 mbd to 0.9 mbd currently:

That’s a 40% decline in the Bakken’s oil production in a bit more than half a year. While we could see additional production brought back online over the next few months, it will soon be offset by the huge collapse in drilling rigs in the region (as well as the rest of the country).

The Bakken’s drilling rig count is down a stunning 78% since the same time last year. In August 2019, the Bakken had 48 drilling rigs working in the region, but today, there are only 11. With such a massive reduction in drilling rigs, it’s only a matter of time before the steep decline rate pulls production down even further.

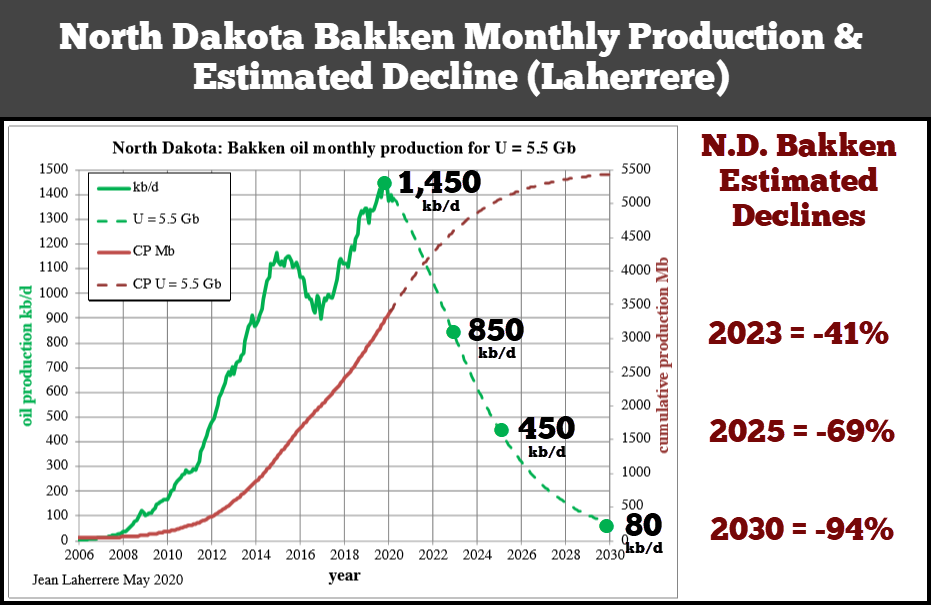

And, if we look at this chart by Jean Laherrere, the forecast for Bakken oil production was set to decline 90+% by 2030, with or without the global contagion.

No comments:

Post a Comment