https://alt-market.us/nothing-is-over-inflation-is-about-to-come-back-with-a-vengeance/

Nothing Is Over: Inflation Is About To Come Back With A Vengeance

Perhaps one of the most bizarre recent developments in economic news has been the attempt by establishment media (and the White House) to declare US inflation “defeated” despite all the facts to the contrary. Keep in mind that when these people talk about inflation, they are only talking about the most recent CPI, which is supposed to be a measure of current inflation growth, not a measure of inflation already accumulated. But, the CPI is easily manipulated, and focus on that index alone is a tactic for misleading the public on the true economic danger.

The way current US inflation is presented might seem like a fiscal miracle. How did America cut CPI so quickly while the rest of the world including Europe is still dealing with continuing distress? Is “Bidenomics” really an economic powerhouse?

No, it’s definitely not. I have addressed this issue in previous articles but I’ll dig into inflation specifically, because I believe a renewed inflationary run is about to spark off in the near term and I suspect the public is being misinformed to keep them unprepared.

First, lets be clear that there are four types of inflation – Creeping, walking, galloping and hyperinflation. We also should distinguish between monetary inflation and price inflation, because they are not always directly related (usually they are, but events outside of money printing can also cause prices to go up).

If we calculate CPI according to the same methods used during the stagflationary crisis of the 1980s, real inflation has been in the double digits for the past couple years. This constitutes galloping inflation, a very dangerous condition that can lead to a depression event.

There are multiple triggers for the inflation spike. The primary cause was tens-of-trillions of dollars in monetary stimulus created by the Federal Reserve, the majority of which took place on the watch of Barack Obama and Joe Biden (there have been multiple GOP Republicans that have also supported these measures, but the majority of dollar devaluation is directly related to Democrat policies). This epic “too big to fail” stimulus created an avalanche effect in which economic weakness accumulated like sheets of ice on a mountainside. The final straw was the covid lockdowns and the $8 trillion+ in stimulus packages pumped directly into the system. Then, it all came crashing down.

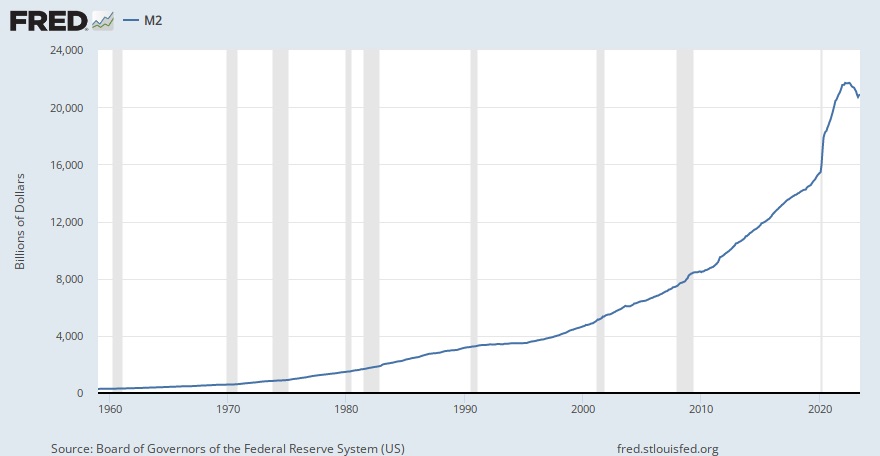

To give you a sense of how bad the situation is, we can take a look at the Fed’s M2 money supply (they stopped reporting the more complete M3 money supply right before the crash of 2008). According to the M2, the amount of dollars in circulation jumped around 40% in the span of only two years. That is an epic amount of money creation and I would argue that the economy still hasn’t processed all of it yet.

There have been too many dollars chasing too few goods and services. Thus, prices rise dramatically, with the cost of necessities increasing by 25%-50%. Think about that for a moment…it now costs us 25%-50% more per year to live than it did before 2020, and it’s not over by a long shot. Houshold costs are still climbing, and since inflation is cumulative we will likely never be rid of the increases that are already in place. But if that’s the reality, why is CPI going down?

The main reason has been the central bank pumping up interest rates. The more expensive debt becomes, the more the economy slows down. That said, the Fed has remained hawkish for a reason; they know that inflation is not going away. They need help if they’re going to convince the public that inflation is no longer a problem.

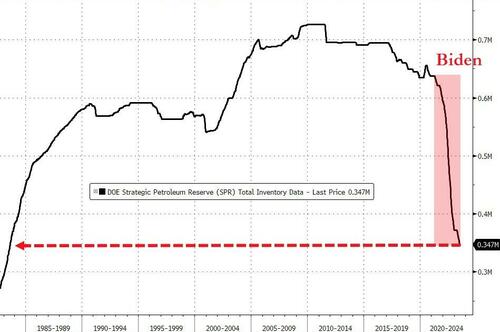

Enter Biden’s scheme of dumping America’s strategic oil reserves on the market as a means to artificially bring down CPI. Energy prices affect almost all other aspects of the CPI index, and when energy costs fall this make it seem like inflation has been tamed. The problem is that it’s a short term fraud. Biden has run out of reserves to dilute the market and the cost of refilling them is going to be exponentially higher. This is why you now see gas prices rising again and they will probably keep rising through the rest of the year.

On top of this there are also geopolitical factors to consider. The White House has earmarked over $100 billion in aid to Ukraine – A proxy war is one good way to circulate fiat dollars overseas as a means to reduce monetary inflation at home, but it’s not going to be enough unless the war expands considerably. Then there is the problem of export disruptions.

For example, Russia is now officially and aggressively shutting down Ukraine’s wheat and grain exports, which is going to cause another price spike in wheat and all foods that use wheat. India just shut down major exports of rice to protect their domestic supply, meaning rice is going to rocket in price. And, there’s an overall trend of foriegn creditors quietly dumping the US dollar as the world reserve currency. All those dollars will eventually make their way back to the US, meaning an even larger money supply circulating domestically with higher inflation as a result.

The Fed doesn’t necessarily have to keep printing for inflation to persist, they just had to set the chain reaction in motion. The recent Fitch downgrade of the US credit rating is not going to help matters as it encourages foreign investors to dump the dollar and treasuries even faster.

To be sure, there is still the matter of the battle between deflationary factors vs inflationary factors. In October, the last vestiges of covid stimlus measures will finally die, including the moratorium on student loan debt payments – That’s trillions of dollars of loans pulling billions in payments each year.

Not only that, but when those loans were put on hold, millions of people magically had their credit ratings rise, which means they had access to higher credit card limits and a vast pool of debt. Now, that’s all going away, too. No more living off Visa and Mastercard means US retail is about to take a considerable hit along with the jobs market.

Then there’s the Fed’s interest rate hikes which are now about as high as they were right before the crash of 2008. The same hikes that helped cause the spring banking crisis (which is also not over). The US will be paying record interest on the national debt, consumers will be using far less credit and banks will be lending less and less money.

So yes, there will be competing forces pulling the economy in two different directions: Inflation and deflation. However, I would argue that inflation is not done with us yet and that the Fed will have to hike a few more times to suppress it in the short term. In the long term, the viability of the US dollar is the issue, but that’s a discussion for another article…

....

https://kunstler.com/clusterfuck-nation/normies-awake/

Normies Awake!

“The West can’t do diplomacy in general, it can’t run its cities or countries except into the ground, its high-tech projects fail almost as a rule, its infrastructure is crumbling, its economies are crumbling, and all public policies seem to have a civilizational suicide as a final goal.” — Gaius Baltar

So-called Normies might be musing, this month of approved mental languor, whether the mighty efforts to suppress news of all kinds, about everything, have concealed the true tendings of our wayward country — leading them to wonder whether it is even possible to be a Normie in such an abnormal time and place.

What news is suppressed? That the USA is worse than dead broke. That the people were poisoned, apparently on-purpose. That the spectral “Joe Biden” sold out our country. That the war we started in Ukraine, on purpose, for no good reason, is about to be lost, and with it our standing around world. That there actually is such a criminal organism as the Blob at large in our government, responsible for the astounding abnormality immersing us. But never mind all that… for now, just go see Barbie. Have a clam roll, a dip in the ocean, another margarita…. September will be here soon enough.

Eventually, the official perversion of money — especially of borrowing an awesome lot of it with no intention of ever repaying — leads to the unhappy circumstance of money disappearing until nobody has any money. And by such, the broke-ness of the government transmogrifies to a whole land full of broke people. Many banks go broke as well. Even the high-fliers who hoarded things that purport to represent money go broke. Then, nobody has the means to buy anything. Businesses that can’t sell anything stop being businesses. After a while, no activity is meaningful except grubbing in the soil to grow some food, or stealing it from those who grubbed and grew it. By then, you can barely even call it a society.

By September, we’ll have some idea where all that is heading. The bond market is wobbling because the government can’t stop increasing its spending. America issues more and more bonds to borrow ever more money, but to the world’s bond-buyers (a.k.a. lenders), what used to be considered virtually risk-free now looks like a bad bet. So, the enticement to buy, which is called the interest rate, has to go up. But as it goes up, the cash value of existing bonds goes down (who wants the older bonds when the newer ones pay more?)

The holders of bonds are mainly big institutions: banks, pension funds, insurance companies, sovereign wealth funds (other countries). They put their large holdings into bonds because in normal times they are safe and dependable investments. But these are abnormal times. When the value of their bonds goes down a lot, the value of their reserves goes down. And when those reserves get reduced too much in relation to the institutions’ liabilities (what they owe), the institutions go bankrupt. When that happens, the people who are vested in those institutions lose their money, too, and end up having to sell stocks and other property to meet their obligations. This ends up looking like what we call “a crash.” It will get Normies’ attention.

How’s it going with the poisoning of America? Since Elon Musk bought Twitter (now “X”), the app has developed a beefed-up immune system against censorship aimed at it by the FBI, CIA, DHS, and the White House. Twitter is once again a popular medium of information exchange, where news flows pretty freely these days. Even news of previous censorship and cancellation is getting out — and with interesting possibilities for consequences.

The many brave doctors who questioned the “vaccine” story, are being heard now. Other entrepreneurial analysts on Twitter — e.g., Edward Dowd, The Unity Project, “The Ethical Skeptic,” “Chief Nerd”— regularly publish data and charts showing America and the rest of the world just how much damage the mRNA shots did to millions of people, how many have been disabled and killed by them. By September, the awareness of what has been done, and the psychopathic degree of official lying about it, could pass that threshold beyond which everybody knows and the great crime is revealed. Expect a major American political attitude adjustment.

There is surely enough publicly-seen evidence to make an impeachment case against “Joe Biden.” The process seems to move slowly, given the traditional lassitude of Congress, but momentum is building as all these other national fiascos careen toward criticality due to abysmal executive leadership. That evidence shows the Biden Family engaged in an international racketeering scheme to peddle “JB’s” influence when he was vice-president. That’s bribery and the very word is in the short passage of our Constitution describing the grounds for sacking a high official.

Rep. Comer’s House Oversight Committee has already dug up voluminous suspicious activity reports in Biden family bank accounts and has promised more, including information of offshore hidden accounts. Jim Jordan’s preliminary impeachment inquiry has drawn up its first witness list which includes the shadowy “JB” aide Michael Carpenter, and the slippery Trump impeachment “whistleblower,” CIA agent Eric Ciaramella — who essentially accused Mr. Trump of attempting to look into the very bribery crimes of the Biden family lately exposed, a pungent irony. When the impeachment process gets underway in earnest this fall, I expect “Joe Biden” will resign, leaving Ms. Harris to be managed by the shadow-president Barack Obama. That in itself will become a crisis of its own.

Our country has vested its prestige and treasure — but not our blood, at least yet — in the preposterous Ukraine proxy war, completely misjudging every element of it. The Russiaphobia of so many Blob officials was amplified by their own dishonest efforts to blame Russia for all the self-created ills of our own national life. The dirty secret of the Ukraine war is that we are no longer in control of events. The Russians are going to settle things there and that poor palooka of a country will be wrested back into their traditional sphere-of-influence, no more to be a troublemaker. I doubt that our puppet, Mr. Zelensky will be in power by Halloween. NATO will cease to exist and each nation of Europe will then struggle to settle its own sovereign hash without much of an industrial economy left. Expect governments to fall.

In the meantime, enjoy the clam rolls, the surf, the corn-dogs at the fair, and all the other blessings of languorous August. Rest up for what’s coming when Normies awake!

No comments:

Post a Comment