https://scheerpost.com/2024/04/04/patrick-lawrence-europes-identity-crisis/

Europe’s Identity Crisis

As European leaders continue to import a version of U.S. militarism, rearmament will cost the Continent its postwar social contract.

Zurich — It is many years now since the French, bless them, revolted as Disneyland Paris arose near the previously uninvaded village of Marne-la–Vallée–Chessy.

Soon enough came the Disney Hôtel New York, the Disney Hôtel Santa Fe, the Disney Hôtel Cheyenne, the Disney Newport Club, the Disney Sequoia Lodge, Disney Village, Parc Disneyland, Parc Walt Disney Studios. Let us not omit Star Wars Hypersonic Mountain among these monuments to the Americanization of Europe.

Blocking imports of American “culture,” and we need the quotation marks, is among the world’s more quixotic undertakings, given the failure rate. But losing the battle against the infantilization of European sensibilities seems the least of the Continent’s worries at this point.

The irrational Russophobia, the proxy war in Ukraine, the disruption of the Continent’s natural place as Eurasia’s western flank, the conjured-from-nothing “threat” of Russian expansionism, support of Israel’s siege of Gaza: These are U.S. imports, too, and Europe finds itself in crisis in consequence of them.

Who are we, Europeans now ask in one or another way. What have we made of ourselves? Are we always to be America’s obedient underlings, taking all orders and refusing none? What has become of us in the 21st century?

European social democracy in its various forms has been vulnerable to the attacks of market fundamentalists and neoconservative ideologues for many years. Now the apostles of “savage capitalism,” as its Latin American casualties call it, and their warmongering siblings begin, this time in the name of Cold War II, what appears to be their final assault.

Europe has vacillated between two contradictory impulses — asserting its sovereignty and succumbing to an undignified dependence on American power — since the mid–Cold War years. Charles De Gaulle was the last European leader to stand with conviction for the Continent’s independence and autonomy.

But Gaullism is no more than a faint and far-off light around Europe today. I reluctantly conclude that, in the moment of truth now upon it, the Continent will make the unwise choice, a self-condemnation that could endure for decades to come.

A long-evident divide between Europeans and those who purport to lead them now widens. The former defend what remains of the socially advanced state erected across the Continent during the first postwar decades.

The latter are poised to tear it down to import a version of America’s military-industrial complex precisely as The Walt Disney Company brought Sleeping Beauty’s Castle to the French capital’s outskirts.

“Europe’s leaders have woken up to hard power” is the headline atop a commentary Janan Ganesh, a Financial Times columnist, published on this topic last week. “To militarize as much as it needs to,” he wrote, “Europe needs its citizens to bear higher taxes or a smaller welfare state.”

This is bitterly succinct. Europe’s leaders and the media that serve them are in the process of normalizing the “need” to turn Europe into a warrior state in the American image — suffused with animus and paranoia, beset with “threats,” never at ease as the social fabric deteriorates.

Identity Crisis

An acute identity crisis — and this is at bottom Europe’s present disorder — has been rolling the Continent’s way like a big, black bowling ball since, I would say, the U.S. began to realize that Vladimir Putin was other than his pliant predecessor as Russia’s president. It has been ever more obvious lately, as I noted in this space a year ago.

“Howitzers instead of hospitals” is how The New York Times put the case at the time. Again, it is dismally on the mark.

There are various reasons the choice Europe faces has since grown yet starker.

One, the Ukraine war is lost and America’s enthusiasm for the Kiev regime has plainly weakened. This leaves Europe to manage the mess on its doorstep while the U.S. can, as is its habit, “move on.”

Hence the European Union’s commitment two months ago to provide Ukraine with €50 billion in “reliable and predictable financial support” over the next four years.

Two, Donald Trump has reignited talk of either a North Atlantic Treaty Organization without the U.S. or the disintegration of NATO. The first of these is a logical impossibility: Is NATO anything more than Washington’s instrument for projecting power across the Atlantic?

And the pleasing thought of life without NATO is, very regrettably, nowhere near even a medium-term possibility. The whither–NATO conversation has nonetheless prompted European leaders to think, or appear to think.

Emmanuel Macron is not stepping back from his assertion last month that Europe must be prepared to send ground troops to the Ukrainian front — this despite vigorous objections to the French president’s position.

Macron, who nurses a de Gaulle complex, purports to favor a more independent Europe when he says such things, and there are those who buy into it. “If we want to be peacekeepers in the world,” Antonio Tajani, Italy’s foreign minister, said in an interview with La Stampa a couple of months ago, “we need a European military.”

I find this sort of thinking altogether facile. Josep Borrell, the E.U.’s usefully forthright foreign policy chief, went straight at the reality when he outlined “the four main tasks on E.U.’s geopolitical agenda” in his speech to the Munich Security Conference two months ago.

The second of these was, yes, “strengthening our defense and security.” The fourth was “sustaining these efforts in cooperation with key partners, and in particular the U.S.”

I thought Borrell was impossibly paradoxical when I first read his remarks in External Action, an online E.U. publication. On reflection, he seems simply a man of forthrightly stated realpolitik: Europe can arm itself all it wants; its current leaders will keep it a dependent adjunct of the U.S. imperium.

It is not difficult to detect among Europeans their restive dissatisfaction with the direction Europe’s leaders are choosing. You find among them a fundamental desire to reject all Cold War-like animosities and live plainly and simply as Europeans.

Polls indicate that large proportions of those surveyed do not trust the U.S. These polls also record a similar distrust of “Putin,” but this reflects the power of the relentless propaganda in major European media as they incessantly demonize the Russian president, as there is considerable acceptance of Europe’s position as the western flank of the Eurasian landmass and the interdependence with Russia this implies.

Zeit–Fragen, a German-language journal published here (and in French and English as Horizons et débats and Current Concerns), recently quoted Egon Bahr, a former German minister and a key figure in the design of the Federal Republic’s Ostpolitik, on this topic.

“Our self-determination stands alongside and not against America,” Bahr said. “[But] we cannot give up Russia because America doesn’t like it.”

Bahr spoke at the German–Russian Forum in Berlin six years ago. As Zeit–Fragen’s editors make clear, the speech still resonates because the majority of Germans — and considerable proportions of other Europeans — strongly favor a return to the rapprochement with Russia the U.S. has more or less required Europeans to abandon.

“Who thinks voters will prioritize rearmament?” Janan Ganesh asked in his FT column last week. “There is little to suggest electorates are willing to accept a rupture of the welfarist social contract in order to tool up.”

I hope Ganesh is right in this observation. As Europeans try to rediscover who they are, the historical magnitude of this moment is difficult to overstate.

The very best one hopes for now is a ripping confrontation between the defenders of Europe-for–Europeans and those who sponsor a version of the militarized monster that long ago overtook America.

Barricades, blocked highways, yellow vests, occupied ministries: As we used to say in the 1960s, “Let it happen, Cap’n.” This will be a war worth waging for the Continent’s soul.

....

https://brownstone.org/articles/fiscal-collapse-accelerates/

Fiscal Collapse Accelerates

In case you thought anybody in Washington was driving this thing, they are not.

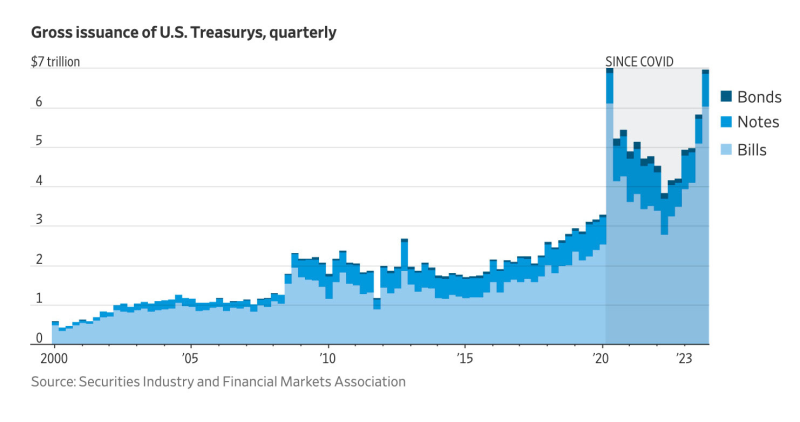

It’s official: the Department of Treasury is now issuing debt at pandemic levels. It’s worth noting the pandemic record was double the previous record, which had stood for 231 years.

In raw numbers, the latest numbers for Q4 2023 show Treasury issued $7 trillion in new debt. For the entire year, it came to $23 trillion.

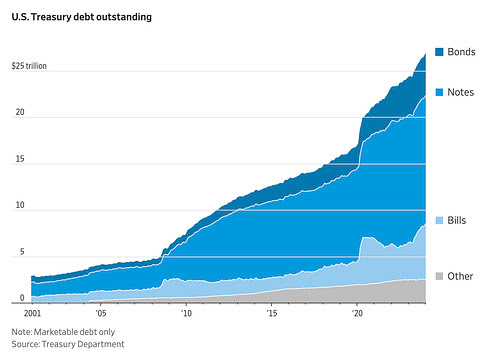

This has bloated the Treasury market to $27 trillion — up 60% since the pandemic. In other words, one third of Treasuries have fresh ink on them. And it’s up roughly sixfold since the 2008 crisis.

Meaning if we hit another crash, it could be a lot bigger.

Sending US Economy to Defaults

At this point, federal debt is rising by $1 trillion every 90 days, and US government spending as a percent of GDP is at World War II levels.

Given we’re not in a World War — in theory — nor are we in a pandemic, why so much debt? Easy: it’s buying growth.

Or as Balaji Srinivasan puts it: “The economy isn’t real. It’s propped up by debt. They will fake it till they break it.”

Even the Wall Street Journal, which loves debt, is sounding the alarm, writing that rapid growth in debt often ends badly, and given the enormous size and alleged safety of the Treasury market any “instability” could be catastrophic.

Why catastrophic? Because US Treasuries are treated like cash by everything from banks to pension funds to large corporations and individual 401k’s. A Treasury is seen as cash that pays interest.

This is false, of course: A Treasury is a promise from Uncle Sam to pay you back someday, perhaps 20 or 30 years in the future.

Meaning that, unlike cash, any concerns investors might have about Uncle Sam’s ability — or willingness — to pay can crash Treasuries.

If that happens it immediately sends the entire banking system, pension system, and hundreds of corporations into default.

Trillions in Fake Debt

Indeed, it could break the payments plumbing in the entire financial system — you wouldn’t be able to get money.

If that sounds dire, recall that all of these are sustained by the gossamir thin belief that Uncle Sam will pay back every penny with interest.

This is curious given that neither voters, who in theory run the government, nor Congress — who actually does run the government — seem to think the debt is real.

You can actually try this at home: tell a voter that student loan bailouts will cost a trillion — meaning $10,000 out of their pocket. Or that another war will cost $30,000 out of pocket. Most don’t care. Because it’s not real.

So the voters don’t think it’s real. Congress doesn’t think it’s real. But literally everything depends on the illusion that every penny of federal debt will be repaid in full, with interest.

What could go wrong.

Conclusion

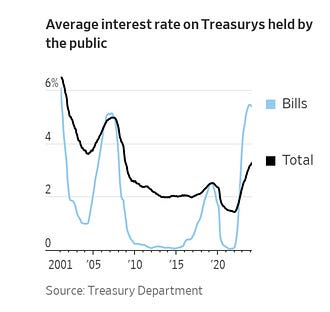

Every fiscal trend is in the wrong direction. We’re already at a $2 trillion deficit, it will soar by trillions when recession hits.

And it will keep churning with Social Security, Medicare, and spending on everything from illegal immigrants to fresh wars.

At this point there is nothing standing between us and fiscal collapse. The only question is when.

....

https://brownstone.org/articles/is-inflation-harmless/

Is Inflation Harmless?

The New York Times has published a strange article by Justin Wolfers, an economist at the University of Michigan. The headline is that his economist brain makes him say with regard to inflation: “Don’t worry, be happy.” The article gives the reader as much reason to trust economists as you do epidemiologists, which is to say not at all.

The idea is that if both prices and income go up together, it all pans out in the wash. Yes, the article goes on for 1,000 words to say that but that’s its essence. The thought is that the 25 percent inflation we’ve experienced over the last 4 years really hasn’t done any damage. Money is neutral to economic exchange and so is inflation.

So just chill!

Inflation is a lot scarier when you fear that today’s price rises will permanently undermine your ability to make ends meet. Perhaps this explains why the recent moderate burst of inflation has created seemingly more anxiety than previous inflationary episodes…we’re in the midst of a macroeconomic anxiety attack.

Now, on the face of it, this claim is notable because he nowhere claims that inflation does actual good, so perhaps that is a step in the right direction. If that’s true, what’s the point of printing up $5 trillion-plus in 2020 and following? No question that this is the direct cause of the loss in purchasing power of the dollar that we’ve experienced. If money is entirely neutral and inflation essentially irrelevant, the Fed should simply freeze the money stock if only to reduce anxiety.

Of course the professor doesn’t suggest that. This is for a reason. Inflation is a form of taxation and wealth redistribution from the poor and middle class to the rich and powerful. Without it, that pathway to wealth transfers would not happen.

Let’s see what the article overlooks about inflation in real life.

First, every inflation comes with injection effects. Not all new money enters the economy at the same time. Some people get it earlier and thereby can spend it before its value starts to fall and fall. They are the winners from inflation. It’s a giant subsidy to the ruling classes.

Think about 2020 and early 2021. Millions of banked businesses and consumers, plus governments most especially, found themselves flush with new cash. Savings soared but so did spending on high-tech goods and delivering services to make the work-at-home economy function.

Many institutions benefited: banks, governments, online learning platforms, online merchants like Amazon, streaming services, and so on. This was part of the Great Reset, to enrich digital enterprise over physical enterprise.

This tendency for new money to affect different industries in different ways was uncovered by the Irish-English economist Richard Cantillon, writing even earlier than Adam Smith. He said that money is never neutral to economic exchanges but rather integral, so every increase in the supply of money has the effect of rewarding some at the expense of others.

Second, you know what’s not affected by the tendency of prices and wages to go up under inflation? Savings. Your money in the bank was not somehow adjusted further up by virtue of inflation. So Professor Wolfers’ entire analysis is blown up as a result: it simply does not pertain to any deferred consumption of the past.

Savings is the basis of investment and thus future prosperity, so inflationary regimes always punish those who are frugal and reward those who live for today and save nothing. Indeed it is deeply punishing toward long-term thinking in general.

Third, none of Wolfers’ thought accounts for the huge transition costs associated with accounting during inflationary bouts. Every business that runs on small margins in a competitive environment has to deal with balancing income versus expenses on large items and small. Accounting alone consumes vast amounts of operational attention in every business. If your costs are randomly going up for all inputs from labor to materials to just keeping the lights on, and each at different stages and in different ways, it becomes much easier to make mistakes.

In addition, it’s easier said than done to “pass the costs onto the consumer.” The ability to do so always depends on the price elasticity of demand, which is a measure of just how trigger-happy consumers really are toward higher prices. How much will demand be affected by changing prices? There is no way to know in advance, which is why merchants end up testing and treading carefully with hidden fees and shrunken packages. It’s all a matter of making the economy work.

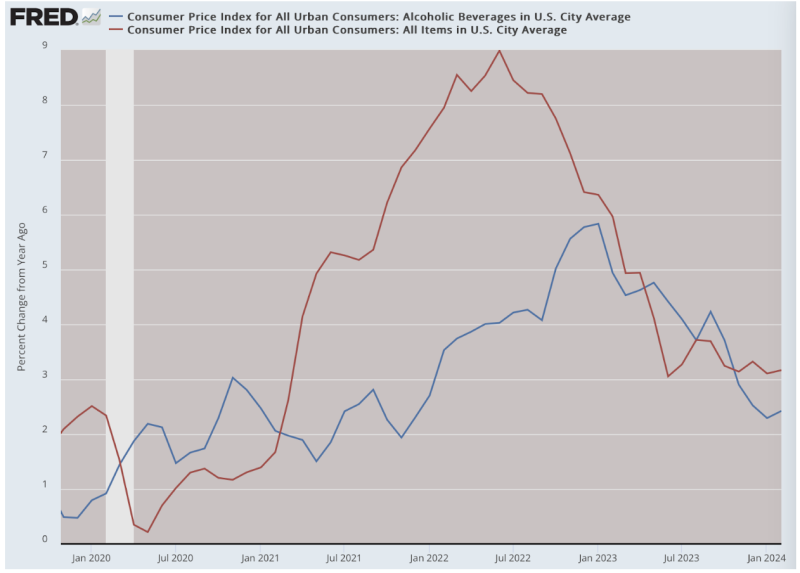

Companies facing less competition and larger profit margins are in a better position to achieve this than those like small businesses which cannot. Therefore the high costs of accounting transitions fall disproportionately on smaller businesses. Did you notice, for example, that liquor prices have not increased nearly as much as other prices? That’s because they were in a position to eat some of their large margins rather than risk reducing demand for their product. That was certainly not true of the corner grocer or the small restaurant.

These are three reasons why this professor’s opinion – born of models in which there are no transition costs, injection effects, or accounting uncertainties – has nothing to do with the real world. And you know this, based on the experience of the last four years. It is an enormous source of frustration when intellectuals use their high-status positions to instruct the public on matters we know to be untrue.

It is also an annoyance to cover up the terrible truths we know. The years 2020-24 were times of one of the greatest head fakes in the history of government and central banking. They showered the world with seemingly free money only to take it all away and then some merely a year later and continuing to this day.

And who won? Look around. Big government is bigger and so is tech and digital businesses in general, while the banks are flush with cash. That tells you all you need to know about who is winning and who is losing in the great inflation racket.

Any economist telling you otherwise needs to let go of the

unrealistic otherworld models and take a look at the reality on the

ground. He might discover that members of the public are not irrational

to be upset but rather entirely in touch with the truth about what has

happened to us.

No comments:

Post a Comment